Enrolled Agent Services

Having gained the Enrolled Agent Credential, Solid Accounting Solutions can now assist with outstanding or unresolved tax issues via Power of Attorney. Enrolled Agents (EAs) are the highest designation recognized by the IRS and have unlimited rights to represent a taxpayer before the IRS in an audit or appeal with the exception of appearing in the US Tax Court. Solid Accounting Solutions is delighted to be able to provide Enrolled Agent Services for clients – both businesses and individuals.

Having gained the Enrolled Agent Credential, Solid Accounting Solutions can now assist with outstanding or unresolved tax issues via Power of Attorney. Enrolled Agents (EAs) are the highest designation recognized by the IRS and have unlimited rights to represent a taxpayer before the IRS in an audit or appeal with the exception of appearing in the US Tax Court. Solid Accounting Solutions is delighted to be able to provide Enrolled Agent Services for clients – both businesses and individuals.

Key points to know about Enrolled Agents…

• Enrolled agents (EAs) must pass a three-part exam* or have worked for the IRS for no less than five years in a position that requires extensive knowledge of the tax code.

• EAs must be current with their own tax returns, and their taxes due must be paid up and current.

• EAs serve the private sector, while CPAs more often specialize in public accounting and attestation.

What are some examples of what an Enrolled Agent can help with?

The most common issue an individual might experience is the case of misreported or under reported income, where the IRS finds documentation on income that was not included in your tax return – that may or may not be accurate. For businesses, it is often a matter of filing tax returns that were missed, due to new business owners not understanding filing requirements.

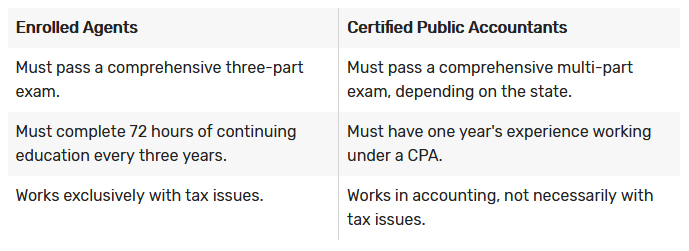

What’s the difference between an Enrolled Agent (EA) and a Certified Public Accountant (CPA)?

The qualifying requirements for EAs are set at the federal level by the IRS; each state sets its own requirements for CPAs. Enrolled Agents with accounting degrees can provide many of the same services as a CPA, with the exception of officially “compiled, reviewed or audited” financial statements.To break it down simply, here is a comparison chart…

TABLE SOURCE: thebalance.com

*To become an Enrolled Agent, one must pass a 3-part rigorous exam and then apply and be accepted by the IRS. To maintain the EA credentials the professionals must complete 72 hours of continuing education every three years.

Tax Problem? No Problem. We are here to help!

Use the form on this page to schedule a complimentary 30-minute consultation.